What is a flexible budget? Definition and example

Content

- Why Would a Company Find a Flexible Budget Variance More Informative?

- How to create and implement a flexible budget for your business

- Flexible Budget: Management Method for Cost Control and Monitoring the Performance of Economic Entities

- Startup Metrics to Keep a Pulse on Your Business

- Step 3: Enter production levels based on actuals

- Accounting Principles II

These points make the flexible budget an appealing model for the advanced budget user. However, before deciding to switch to the flexible budget, consider the following countervailing issues. The devil’s in the details, so keep the first page high level. In budgeting meetings, McFall frequently sees What Is a Flexible Budget in Simple Words? people getting into minutiae that have nothing to do with the overall evolution of the budget or the financial health of the company. Expense Type Description Examples Fixed Costs that do not change over the short-term, even if there is a shift in the amount of goods/services produced or sold.

What are the two types of flexible budget?

The flexible budget can be categorized into three different types. These include the basic flexible budget, intermediate flexible budget, and the advanced flexible budget.

Also, a vivid classification of the expenses into different categories of fixed cost, semi-variable cost, and variable cost is necessary before preparing a budget. A flexible budget is a budget or financial plan of estimated cost and revenue for different output levels.

Why Would a Company Find a Flexible Budget Variance More Informative?

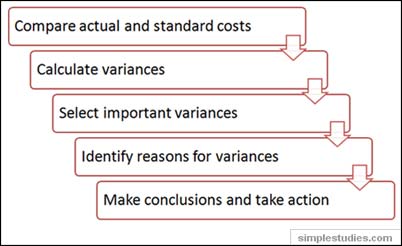

The reason is that budgets are the forecasts for future activities. And the actual output may be more or less than the budgeted ones. A flexible budget makes it easier for businesses to see more variances. During your higher-earning months, you would save for the months where your income isn’t as high. Prepared a flexible budget using the cost behavior data and the selected activity level.

- By updating budgets to reflect those changes, you can quickly course correct to improve efficiency or enhance performance.

- The difference between the amounts within the flexible budget and the actual expenses and revenues will need to be determined to find the variance in the operating income.

- A flexible budget cannot be preloaded into the accounting software for comparison to the financial statements.

- Now, the league is looking to tweak its plan to adopt best practices from other sports, address shortcomings and better fit the changing circumstances.

- But post-production, the company produced an output of 450 units.

- Additionally, flexible budgets have a lack of accountability to some degree since they are so fluid and open to change.

Its production equipment operates, on average, between 3,500 and 6,500 hours per month. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. Sales increase, but commissions do not increase at a similar rate, since the commissions are based on cash received, which has a 30-day time lag. After a disastrous start to the 2020 season, the MLB was forced to regroup. Now, the league is looking to tweak its plan to adopt best practices from other sports, address shortcomings and better fit the changing circumstances.

How to create and implement a flexible budget for your business

It allows the identification of its generating factors so that managers can act on the controllable elements that influence the achievement of this priority objective https://business-accounting.net/ (Aslău, 2001). Selmer says that in order to be efficient and effective, the budgetary mechanism must be in line with the company’s economic management.

For instance, if your company produced 50,000 units in January, and you want to budget for 75,000 units in February, you have to look at your variable costs. While variances are noted in static budgets, a flexible budget allows you to enter the revenues and expenses relevant to that particular budget period, adapting flexible costs using real-time data. The first column lists the sales and expense categories for the company. The second column lists the variable costs as a percentage or unit rate and the total fixed costs.

Flexible Budget: Management Method for Cost Control and Monitoring the Performance of Economic Entities

Companywide financial data is kept in one centralized and up-to-date location, offering greater visibility over financial plans, forecasts and budgets. This also makes budget monitoring and maintenance an easier and more collaborative process. In this, one prepares different budgets for varied activity levels. Among all, the one closer to the actual activity is to be considered. After that, one needs to analyze the performance and cost analysis by comparing both. Flexible budgets allow managers to adjust plans easily when activity level differs from the expected level. Such budgets address “what is” rather than “what was” or “what was expected”.

0 comments